Banking and Insurances: Two Industries on the Move

The signs are pointing to radical modernization, opening and the rise of new business models

So, blockchain will solve all our problems? Of course not. But the ubiquitous digitalization of business and private life is radically changing users' expectations. Anything has to be faster – at any time and anywhere – on the mobile phone or via Alexa. And it needs to be personalized. More performance at lower costs is what users want!

Our customers have understood: in order to compete, they must offer and continuously develop an innovative, customer-oriented service and product portfolio. In doing so and by taking up general and industry-specific trends, jambit supports companies as competent implementation partner:

Cost pressure as a result of lower margins

- Digitization and automation of existing processes and products (STP)

- Robot controlled process automation (RPA)

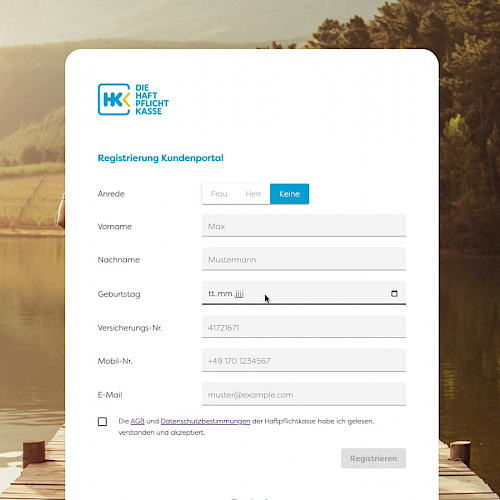

- Digital onboarding (incl. KYC, VideoIdent and Schufa)

- User-centered self-service portals for end customers and intermediaries

Changed customer expectations require short response times

- New distribution channels, faster time-to-market and individualisation of products

- Artificial intelligence and machine learning in speech processing/chat bots and prediction/recommendation systems

- Blockchain (crypto currencies and smart contracts)

- Fully digital decision-making processes for e.g. lending and underwriting

- Machine learning for process acceleration and process assurance in contract processing (agent handling) and casework

Constant tightening of regulation and new standards

- Agile corporate culture and processes to respond flexibly and quickly to any changes

- Agile software development enables simultaneous adaptation and further development such as end-user computing (EUC)

- Business process management: tools and solutions

- PSD2 and MiFID as challenge and opportunity for ASPSP and TPPs at the same time

- Strong customer authentication (e.g. with biometrics) for better security

Modernization of obsolete system landscapes

- Technological modernization of legacy applications with powerful APIs

- Architectural realignment of the IT system landscape according to the principles of a scalable microservice or stream architecture

- Cloudification, evolution and migration

Cybercrime and IT Security

- Data science and machine learning for error detection and fraud prevention

- Secure code and secure architecture

- Robust and fail-safe microservices: service mesh

- TLS encryption and OAuth2

New, international competitors

- Digital transformation: New products and processes, flexibilisation and expansion of core business

- Open banking and open insurance: deployment and monetization of existing services through developer portals, API management, and partner integration

- Banking and insurance as a service

- E-commerce, data-driven cross-selling and digital marketing integration

- Mobile payment (incl. Google Pay and Apple Pay)

- Customer-centric UI and UX concepts and implementation

Our know-how

jambit: technology competence with industry knowledge

jambit is a reliable partner for banks and insurance companies on the path to digital transformation. From cross-sector innovation consulting to idea generation, from the development of technical concepts and prototypes to the implementation of sophisticated software projects in the front- and back-end area. For us, time-to-market and agile development and project management methods are the key to successful, customer-oriented software solutions giving our customers a strong competitive position.

All rights attached to the created solutions are always directly conferred upon the customer to avoid any dependencies. In addition, it is an important advantage for many of our customers that we have been owner-managed for 20 years now and speak German.