Stadtsparkasse München - Conception and development of digital products and services

Open navigation

Open navigation Used methods: Agile approach, User Centered Design, Requirements Engineering

Used Technologies: Angular, Docker, Spring Boot, OpenAPI

jambit supported Die Haftpflichtkasse with the new conception and development of an online customer portal for insurance customers.

Insurance customers expect fast and reliable information and easy ways to contact their insurance company nowadays. They also want to order products and contract online. A digital strategy is therefore important for insurance companies to digitize sales and offering processes, but also daily customer communication, and to remain competitive.

But the changes must also be in line with the company's needs and opportunities. Medium-sized insurance companies need technical solutions that are scalable and can be integrated into the existing system landscape. jambit's development team from the business division Banking & Insurance worked with Die Haftpflichtkasse to design a customer portal in a holistic user-centered design process and accompanied the front-end and back-end development.

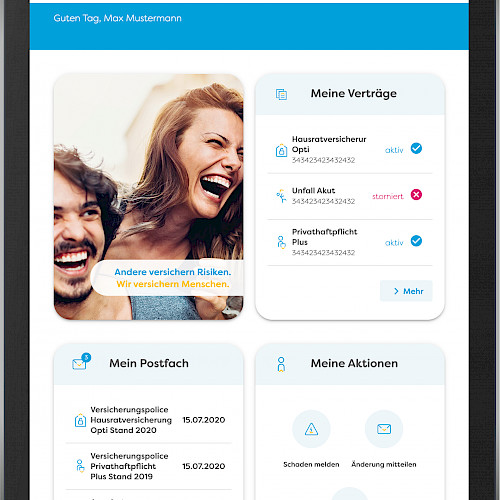

With the new portal, Die Haftpflichtkasse creates a digital customer experience. The portal helps to manage contracts and offers the user insight into the status of their order. A mailbox informs about important contractual adjustments or information. Target-oriented interaction options provide information that reduces the insurer's data entry effort and supports the digital customer experience.

In a workshop at the beginning of the project we defined general conditions and created a basis for decision-making. jambit accompanied strategic decisions on "Make or Buy" and advised on the selection of partners, technologies, and procedures. A systematic approach for specifying and managing requirements was important to the customer and jambit during the development phase.

Continuous requirements engineering between contact persons of the insurance company and jambit developers ensured stakeholder involvement, a consistent specification, and reduced development costs. For Die Haftpflichtkasse, the development was aimed at an independent and decoupled system receiving data from the insurance company's inventory system. This enables the customer portal to offer new features without generating high investment costs in the existing IT system landscape.

Important for a customer portal: the secure interface development between the customer portal and the inventory system for retrieving data from authorized clients such as the web application and data storage. An open source solution for identity management now offers the advantage that users authenticate themselves with a solution instead of individual applications. This way, the application does not have to deal with login forms, user authentication, and user storage.

Die Haftpflichtkasse is a mutual insurance company with headquarters in Roßdorf near Darmstadt. With more than 350 employees, the property and casualty insurer, which is active throughout Germany, manages around two million insurance policies with a premium volume of more than 200 million euros. Their portfolio include personal liability, contents, and accident insurance for private customers and public liability, closure of operations, environmental damage, and AGG (General Equal Treatment Act) insurance for corporate customers. Digital applications, such as the development of an online customer portal, are an important element in the insurer's successful expansion strategy.

If you have any questions, please do not hesitate to contact Michael Röme, Head of Division Banking & Insurance. Just leave him a message via the contact form.

Contact us now